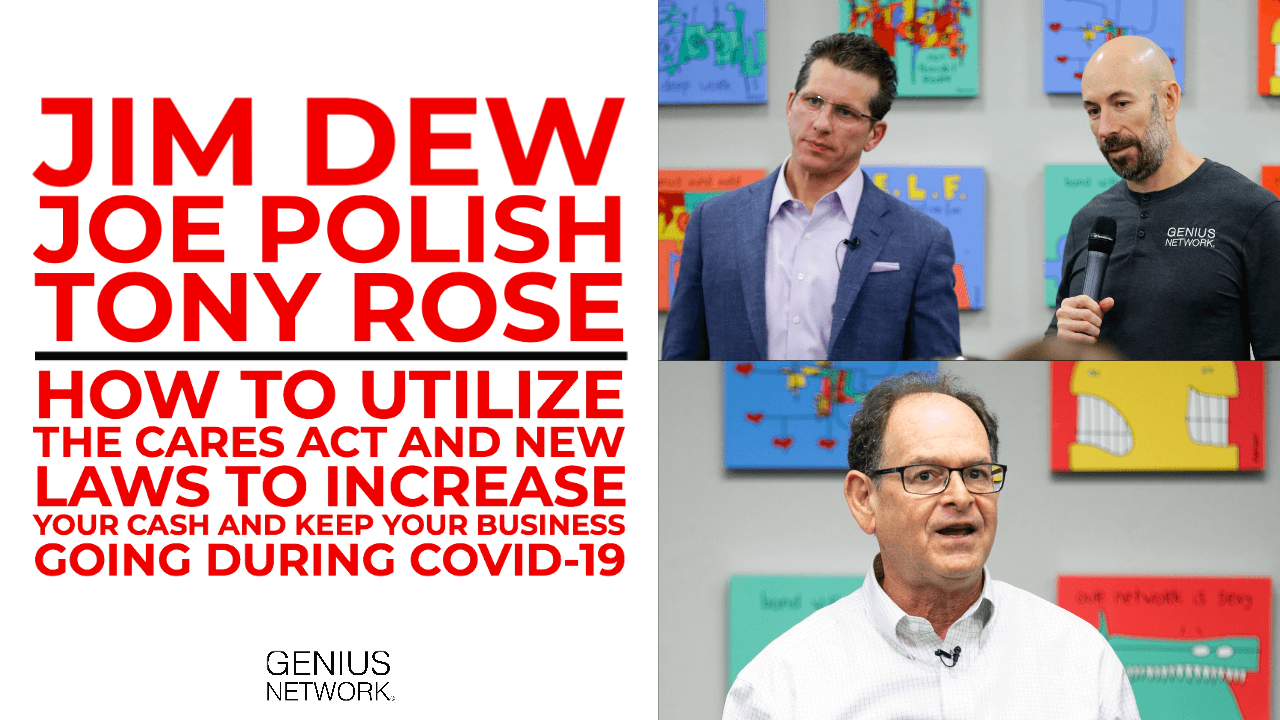

How To Utilize The CARES Act and New Laws To Increase Your Cash and Keep Your Business Going During COVID-19 Featuring Jim Dew, Tony Rose, and Joe Polish – Genius Network Episode #142

Episode Summary

It’s hard to comprehend the enormity of the new CARES Act – but it can certainly help those who need and know how to take advantage of it. Learn what it all means in today’s episode of the Genius Network Podcast. In this episode, Jim Dew, Tony Rose, and Joe Polish discuss the key elements of the CARES Act that can help business owners and Entrepreneurs during this time of uncertainty. They’ll also break down the mindset and focus required to get through this time of crisis stronger, more resilient, and more purposeful than ever.

If you’d like to join world-renowned Entrepreneurs at this year’s Genius Network Annual Event – then apply today for your invitation to attend. If you’d like to learn more about the Genius Network Annual Event or to apply, go to www.GeniusNetwork.com.

Here’s a glance at what you’ll learn from Jim, Tony and Joe in this episode:

- The COVID-19 CASH Conversation: How To Utilize The CARES Act and New Laws To Increase Your Cash and Keep Your Business Going During COVID-19 (Featuring Jim Dew, Tony Rose, and Joe Polish)

- Jim and Tony discuss the $2.2 Trillion CARES Act, the Federal Paycheck Protection Program, and how you can apply for it to maintain your cash flow and keep your employees

- The tax and legal implications you MUST be aware BEFORE you apply for COVID-19 loan and grant programs (This could save you hundreds of thousands of dollars…)

- Why you should NEVER keep deposits in a bank you owe money to (PLUS: One way to get cash from your bank WITHOUT having to sell your portfolio…)

- Jim’s C.O.V.I.D. Decision Model: The “C.O.V.I.D.” decision-making process you can use for making tough business decisions during the COVID-19 crisis

- A grant you can get right now if you need IMMEDIATE money; A specific loan you can get for up to $2 million; and a 50% payroll tax deferral you can utilize

- Jim talks about new laws that can help Entrepreneurs get money back from taxes they paid in the past – AND – several other ways you can conserve cash

- How to maintain the right mindset during this crisis and the OPPORTUNITIES in business, real estate, and stocks Entrepreneurs should be thinking about

WHAT'S IN IT FOR THEM?

Get the first chapter for FREE and a limited-time viewing of "Connected: The Joe Polish Story"

Show Notes

- The CARES Act is enormous – which makes it difficult to unpack it all.

- There’s a lot in the bill that can benefit Entrepreneurs and business owners.

- Figure out what you need to survive – and do it now before you get in trouble.

- The Payroll Protection Program: It’s designed to keep people working by subsidizing businesses of 500 employees or less through an SBA loan program.

- The loan has a 2-month payroll forgivable portion.

- There are other SBA programs as well – but as a general rule, you can’t double-dip.

- Think about your business today and the uncertainty you face due to COVID-19.

- How to get the forgiveness: Keep the same number of employees compared to the same period of 2019 or Jan./Feb. of this year and don’t cut salaries by more than 25%.

- Everyone in the U.S. is uncertain right now.

- The loans have deferred payment of 6-12 months, the process has been simplified, and it’s a non-recourse loan.

- Make sure you speak to your accountant and lawyer about how this will impact your finances, taxes, and loan terms.

- Cash is king; think about your access to cash and the cash value of your assets.

- Outgoing: Track your spending but don’t get rid of useful things.

- Variable vs. Fixed: Know what costs move and which are set. Don’t always cut variable costs and you can possibly increase revenue.

- Incoming: Recurring revenue holds up better than one-time revenue. Offer no-pay, low-pay, or pre-pay – and find new streams of revenue.

- Decisiveness: Lean in and make purposeful decisions.

- Get a securities-backed line of credit and look at your insurance policies for cash.

- Establish how long you can exist in a world where revenue is less or lost.

- The four C’s: Content, Context, Communication, Comprehension.

- Information is going to be important – collaborate and conclude with advisors.

- The SBA is providing a $10,000 grant and loans, there are payroll tax deferments, too.

- You can delay the filing of your taxes and tax refunds can be accelerated.

- Net Operating Loss: There are certain new strategies you can deploy.

- A system for figuring out what systems and programs are best for you.

- Understand your burn rate and your run rate.

- This experience may show you the right size of your company.

- Take advantage of the wisdom that’s out there that’ll help you run your business better.

- In the CARES Act, student loan payments can be suspended until September 30th.

- You can take out up to $100,000 from an IRA or 401K – required distributions are no longer required in 2020.

- Determine your purpose so you can get through this.

- Be open to having a network and a close support group.

- Respond, don’t react, with the information in this podcast.

- Don’t get stuck thinking about how bad things can get – think about opportunities.

- The stock market is a leading indicator – don’t pretend to be a great stock-picker.

- Buy a basket of stocks or an index but don’t let this distract you from your business.

- Reach Tony at trose@rsjcpa.com and check out his Beautiful Grief website.

- Check out Jim’s Website, Make Rich Real℠ Scorecard and contact him at jim@dewwealth.com.